Unlock the key to long-term financial prosperity by constructing a vibrant and varied investment portfolio. Minimize risks and boost returns as time progresses using this powerful tool. Join us as we delve into the significance of portfolio diversification and equip you with effective strategies to establish your own.

Why is Diversification Important?

Diversification is important because it helps to reduce risk. When you have all your money invested in one company or one sector, you are exposing yourself to a significant amount of risk. If that company or sector experiences a downturn, your entire investment could suffer. On the other hand, if you have a diversified portfolio, you spread your risk across many different companies and sectors. This means that if one company or sector experiences a downturn, your overall portfolio is less likely to suffer.

Tips for Building a Diversified Investment Portfolio

- Understand Your Risk Tolerance: Discover your financial personality by identifying your risk tolerance – a crucial factor that gauges your appetite for potential rewards at the expense of uncertainty. As a cautious player, stable investments like bonds or blue-chip stocks might be your go-to. However, if you embody an adventurous spirit, taking greater risks with growth stocks or emerging market ventures could entice you to the prospect of soaring returns.

- Invest in Different Asset Classes: Craft an eclectic investment portfolio by incorporating a variety of asset classes like stocks, bonds, and real estate. These distinctive assets offer unique features and adapt distinctly to fluctuating market scenarios.

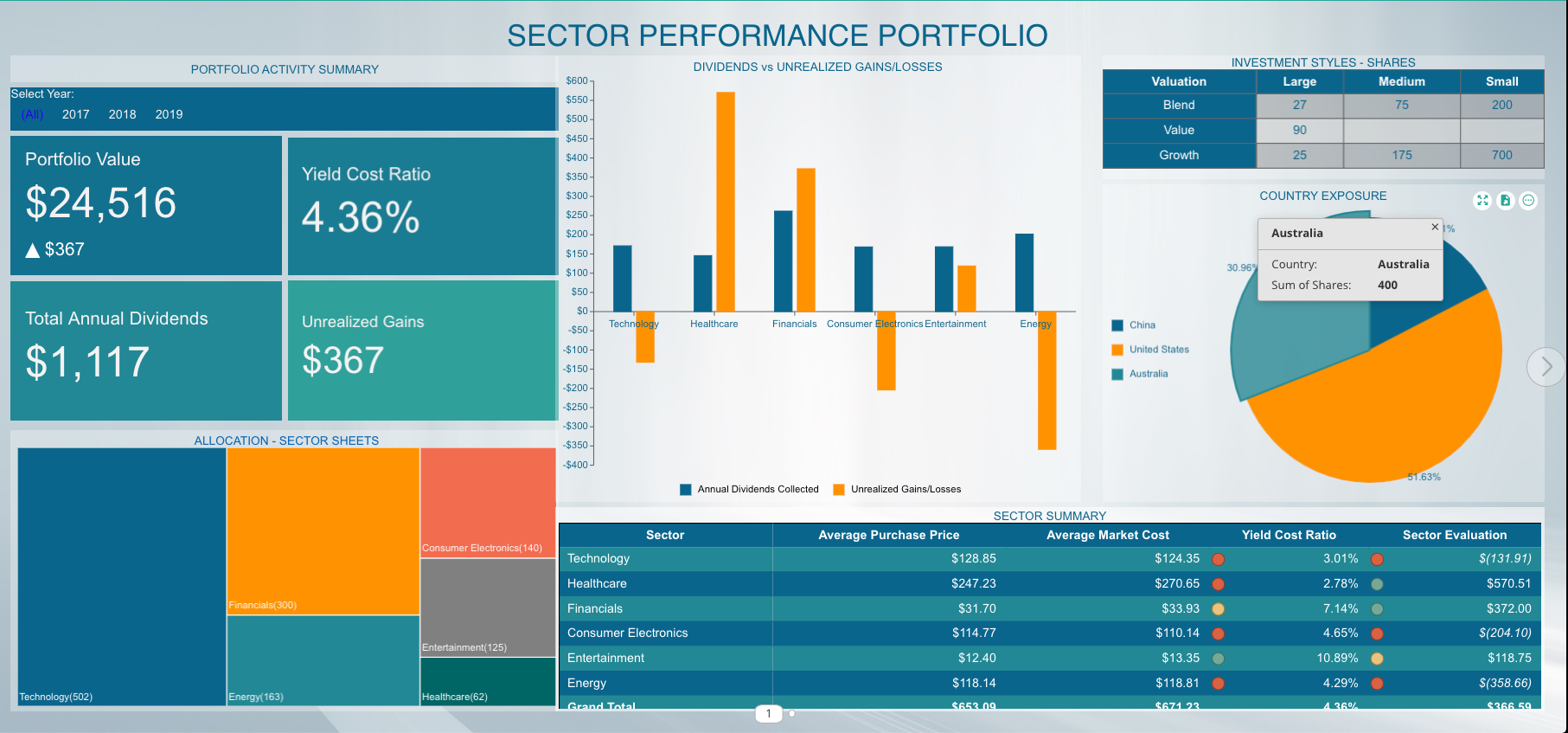

- Invest in Different Sectors: Diversifying your portfolio across various sectors, such as healthcare, technology, and energy, is fundamental to reducing investment risks. By smartly spreading your assets across these key categories, you can better navigate sudden market fluctuations and safeguard your financial future. Embrace the power of diversification for a secure and dynamic investment strategy.

- Choose Quality Investments: Crafting a well-rounded investment portfolio calls for the strategic selection of top-notch assets. Keep an eye out for entities boasting an impressive history of accomplishments, a robust financial standing, and a unique edge over the competition.

- Rebalance Your Portfolio: As market fluctuations sway the harmony of your investments, remember to fine-tune your portfolio periodically. Aligning it with your investment aspirations and risk appetite ensures a continuing, orchestrated financial journey.

To wrap up, the key to unlocking enduring financial prosperity lies in cultivating a multifaceted investment portfolio. By grasping your risk appetite, venturing into varied asset groups and industries, handpicking superior investments, and consistently fine-tuning your portfolio, you’re paving the way for minimized risk and maximized returns in the long run.